Protect your account from Fraud

Manage your cards by remote control

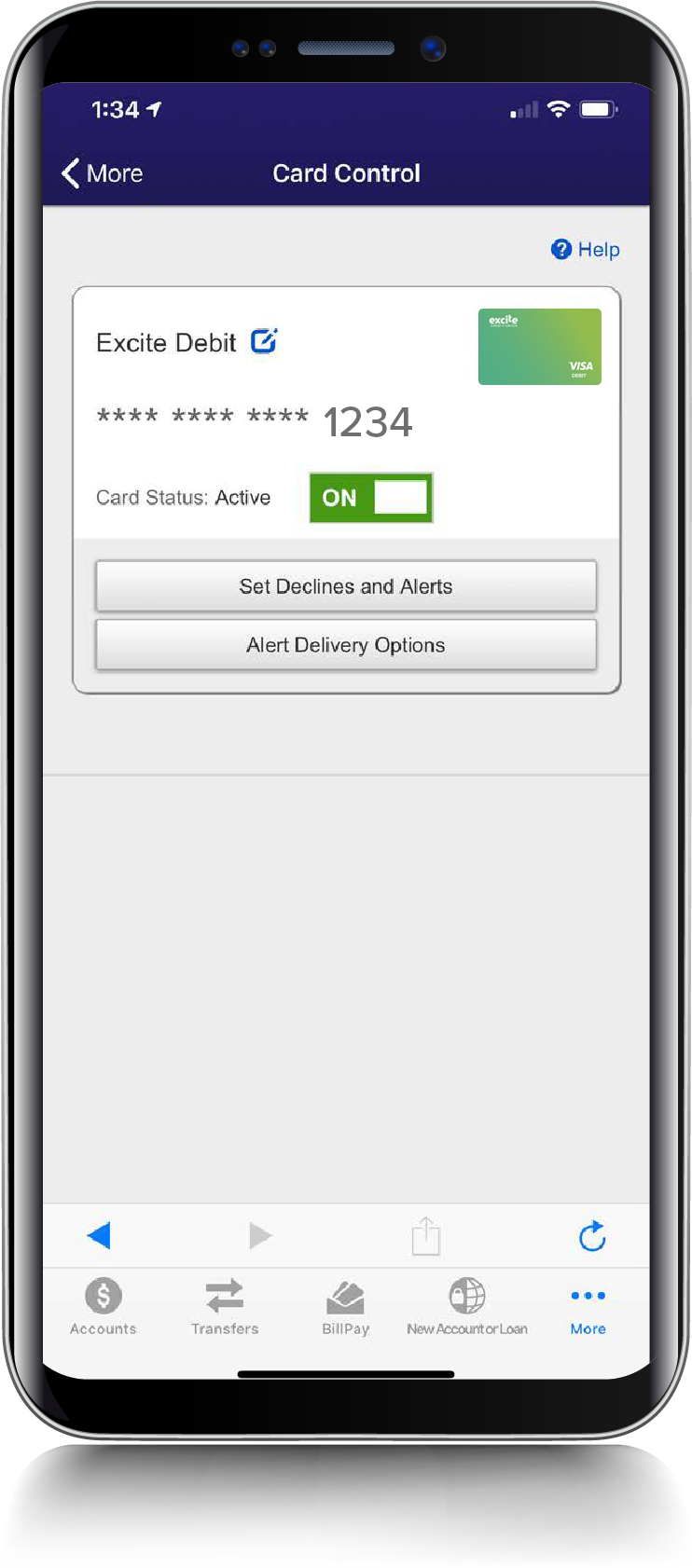

Excite offers real-time control over your debit and credit cards through your PC, smartphone or tablet. Excite's Card Controls application adds another level of security to your debit and credit cards by letting you decide how and when they can be used, and alerting you when any types of transactions you specify take place. This allows you to immediately identify unauthorized transactions and gives you the ability to temporarily turn your card off to avoid further unauthorized charges. You can even set personal spending limits that help you stay within your budget goals.

Card Controls allows you to:

- Turn cards on or off

- Monitor activity

- Limit card use to specific merchants, or purchases.

- Receive alerts when you’re getting close to any personal spending limits you’ve set.

- Receive near-real-time alerts that alert you to unauthorized purchases to help prevent additional fraud.

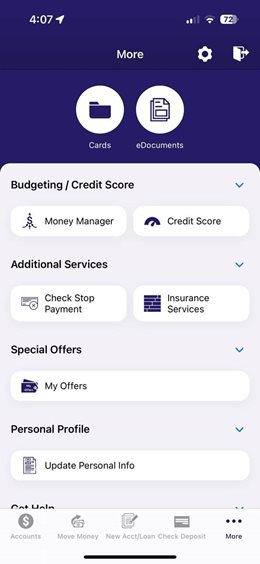

Setting up Card Controls on your mobile app:

- Log in to Mobile Banking

- Select the More button, then select Card Controls

- Select between Debit Card Controls and Credit Card Controls

All cards that are activated will display after accepting the Terms and Conditions. There are no separate usernames or passwords required for Card Controls.

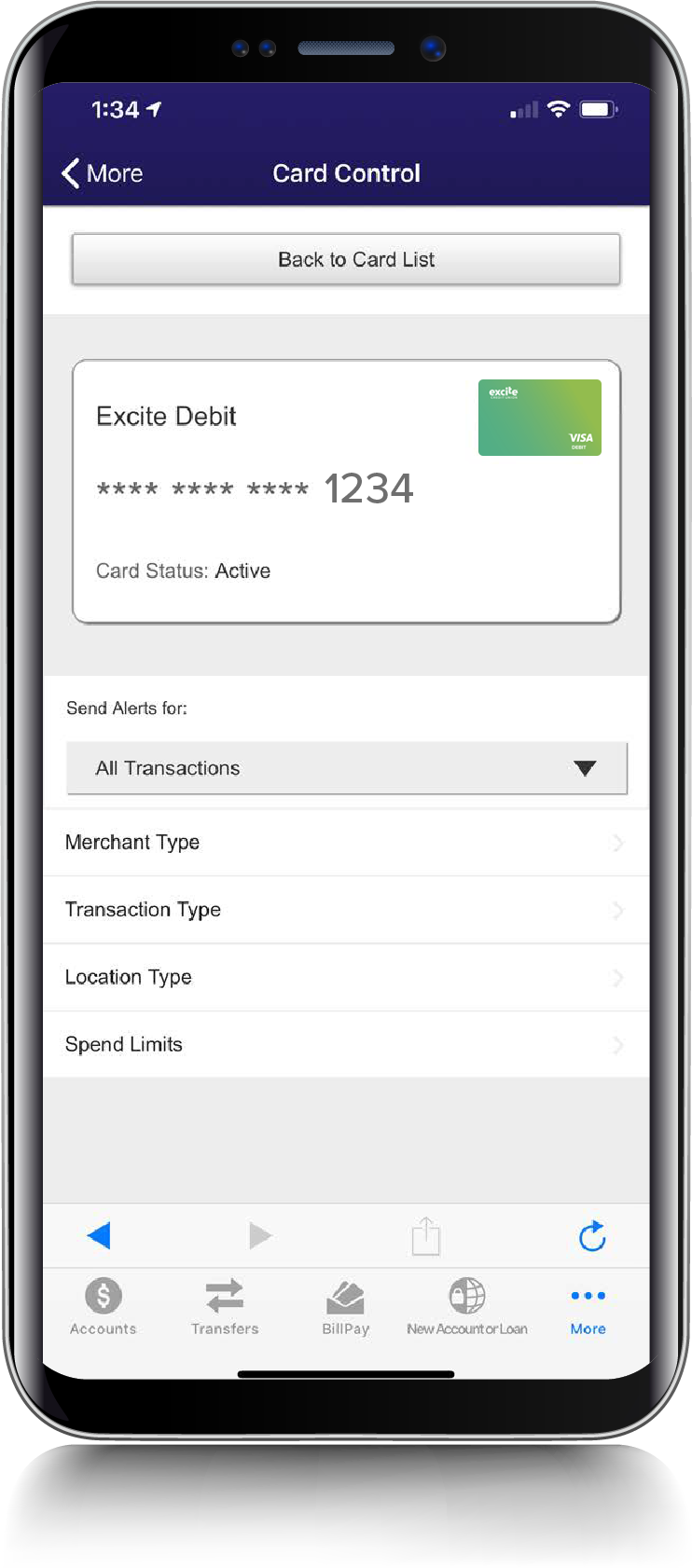

- Set up your preferences for managing transactions

Frequently Asked Questions:

Cardholders can control when and where their cards can be used as well as view and act on instant alerts when transactions are processed, perform card management functions such as turning the card on/off, and perform basic online and mobile banking functions such as view balances and transactions, and search for nearby ATMs.

• Control when and where your card is used

• Receive near-real-time notifications to alert you of any unauthorized use

• Access and manage cards anytime, anywhere

• Secure your accounts by locking your card when not in use and unlocking for use

• Control dependent purchases to avoid misuse

• Track monthly spending at a glance

Card Controls enables you to define controls for card usage and to define preferences for alerts to be received when transactions using the enrolled card are made or attempted. You enroll by accepting the Card Conrols Terms and Conditions either through Online or Mobile Banking. Once enrolled, you can set real-time controls and receive near-real-time alerts based on preferences identified. You can either access Card Controls by clicking the Card Controls link within Online or Mobile Banking.

Card Controls has many services to give you:

Controls –From the convenience of your PC or smartphone:

- Turn the card on or off

- Set thresholds for transaction amounts

- Specify the types of transactions and merchants where the card can be used

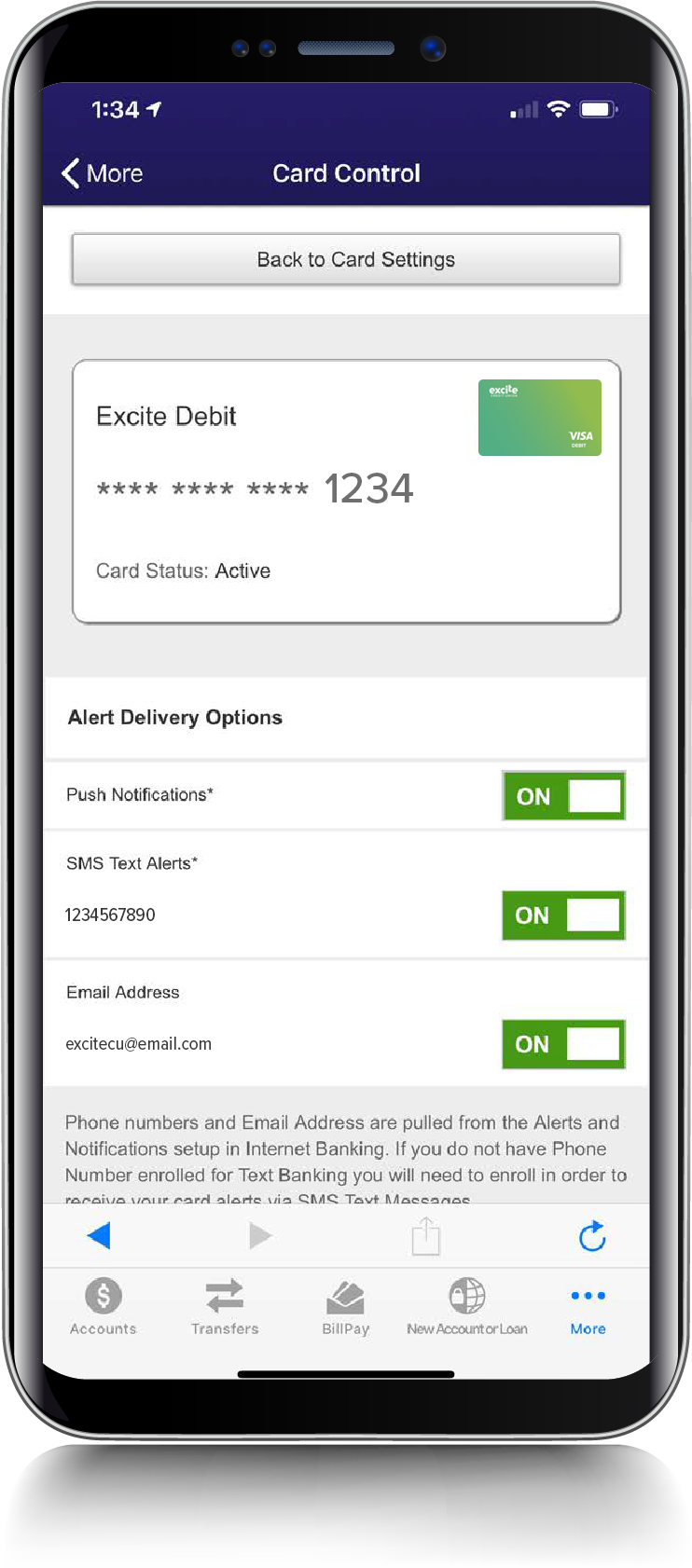

Alerts –Members can choose to receive real time alerts:

- By Transaction type – based on type of transaction at point of sale

- By Merchant type – based on the type of merchant where the transaction occurred

- By Threshold – based on the threshold amount set by the user

Limit Fraud –Stop fraudulent transactions in their tracks. Card Controls will automatically decline

transactions that fall outside of your chosen settings.

Will Card Controls work outside the U.S.?

Yes. If you have access to Online Banking or your phone has an internet connection, the app will work.

Can transactions be conducted in foreign currencies?

Yes. Transaction amounts are displayed in US currency, but transactions may be initiated and authorized in any currency.

How long can I leave my card “OFF”?

You can turn your cards OFF, leave them OFF as long as you want to, and only turn them back ON when you want to perform transactions.

How many cards can each user set up?

There is no limit to the number of cards that a user can set up; however it must be an Excite Visa Debit or Credit Card.

Do Card Controls work regardless of how the card is used (i.e., plastic, EMV, Apple or Android Pay)?

Correct, that is the beauty of this product. EMV helps prevent fraud for card-present transactions. Card Controls also helps identify potential fraud for card-present, online and auto-pay transactions.

Are the alerts via push, or do you have to be logged in?

Alerts are push notifications in app. You do not need to be logged in.

When the card is off, most card transactions are denied by Card Controls and alerts are generated for attempted transactions. However, auto‑pay transactions and credits (deposits, returns and reversals) are exempt from this high‑level control.